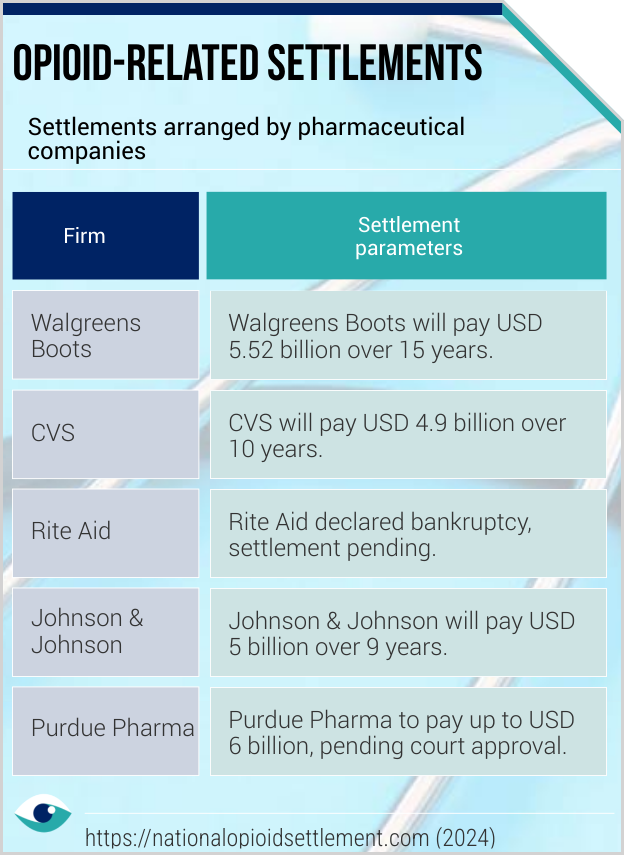

Major pharmaceutical retailers that supplied highly addictive opioids, contributing to a US health crisis, continue to face severe financial pressures from ongoing litigation. As of late 2024, Walgreens Boots has reported total opioid-related liabilities of USD 5.5 billion. The company has undertaken cost-cutting measures, including the closure of underperforming stores. CVS has faced similar challenges which pre-empted opioid-related settlements of USD 5 billion. Meanwhile, in October 2024, Rite Aid just emerged from Chapter 11 bankruptcy as a private company after a restructuring under the weight of opioid claims which far exceeded insurance coverage.

The opioid crisis: a cautionary tale for the health sector

Firms are paying out billions to settle litigation and emerging more resolutely focused on drug distribution and stakeholder engagement

Policy

Health (all industries)

Publication date: 28 Sep 2024

By Eye For Business

AT A GLANCE

Litigation against major US pharmacies over their role in the opioid crisis has resulted in billions of dollars in settlements.

Recent reports from major pharmaceutical chains highlight the financial strain and risks to future liquidity.

Health industry firms must prepare for the serious consequences of patient addiction and drug misuse.

Consolidated settlements

Other businesses at risk of opioid litigation have continued to create large settlement funds to address mounting lawsuits. In 2024, Johnson & Johnson confirmed a settlement of USD 5 billion as part of a broader agreement to resolve all opioid claims. Meanwhile, Purdue Pharma, still under bankruptcy protection after the US courts rejected its settlement plan, made further payments in 2024 as part of its USD 6 billion settlement plan. These payments, totalling more than USD 1 billion, are being directed towards state opioid abatement services and compensation for individuals and families affected by the crisis.

Beyond the lump sums

The financial toll of opioid-related litigation continues to threaten entities' working capital and shareholder value. Legal battles pose significant reputational risks, as highlighted in recent disclosures. Even as Rite Aid exits bankruptcy protection, the firm expects persistent reputational damage regardless of the outcome of litigation. CVS and Walgreens Boots attest to adverse operational impacts of prolonged litigation, which diverts resources and delays other initiatives. Firms face pressure to balance financial recovery with rebuilding trust with stakeholders as litigation drags on.

Mitigating future legal action

Industry firms are focusing on stakeholder engagement to mitigate reputational risks. In 2024, CVS expanded its efforts by increasing the number of medication disposal units and enhancing pharmacist-led counselling. The firm also committed funds towards community education, targeting areas hardest hit by the opioid crisis. Walgreens Boots has also intensified its engagement, rolling out educational programs in collaboration with health authorities and local organisations.

Prioritising engagement

Profits from opioid sales are now being diverted to settle litigation as the hidden costs of patient addiction surface. The lesson learned from the US opioid scandal is that to avoid further legal and reputational risks, firms must prioritise responsible drug distribution and early stakeholder engagement.

FURTHER READING

- Treatment for Opioid Use Disorder: Population Estimates (CDC)

- Prescription Opioid Dose Reductions (Journal of General Internal Medicine)

- National Opioids Settlement (Plaintiffs’ Executive Committee)