The growing trend toward platform electrification in the energy sector is gaining attention as offshore wind energy integration aims to cut emissions and reduce operational costs. Despite its potential, the shift remains in its early stages, facing substantial technological challenges and regulatory uncertainties. Electrifying oil and gas platforms is widely recognised as an effective way to lower greenhouse gas emissions, ensure compliance with global carbon pricing and reduce operating expenses. By enhancing technical capabilities and forming partnerships with renewable energy companies, businesses reduce costs while aligning with offshore wind expansion.

Platform electrification: reducing costs and carbon in oil

Upstream electrification aligns oil operations with emissions goals, reducing carbon in supply chains and supporting cost-efficient sourcing

Value chain: upstream

Hydrocarbons

AT A GLANCE

Platform electrification offers oil companies a significant opportunity to cut emissions and meet regulatory standards for carbon reduction.

Wind integration is still at an early stage, with significant technological challenges and regulatory uncertainties to overcome.

Electrified operations will enhance competitiveness, meet investor expectations and ensure compliance.

Cost efficiency benefits

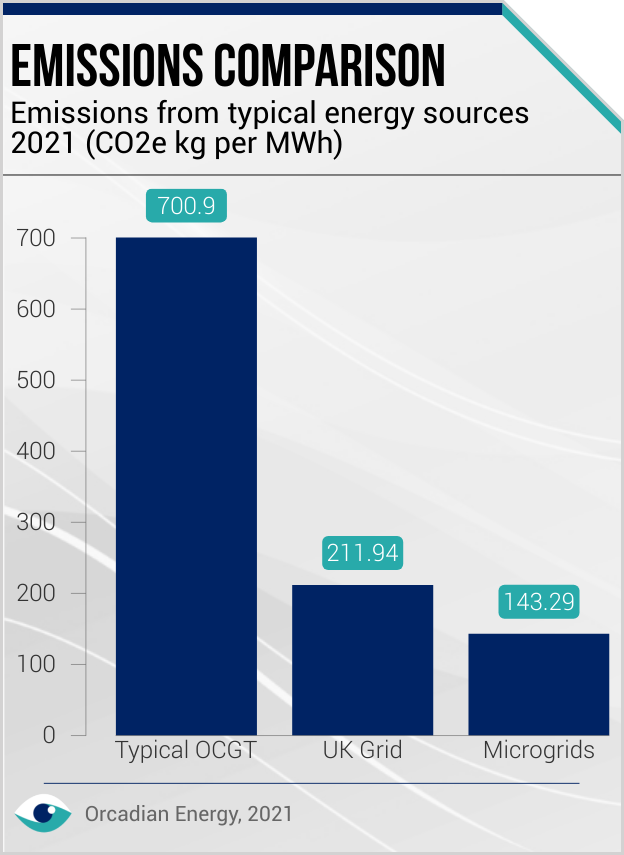

Offshore platform electrification significantly reduces long-term maintenance and operational expenses, addressing a primary industry cost concern. Using submarine cables instead of gas turbines reduces fuel consumption and decreases maintenance needs cutting life-cycle costs by up to USD 1.2 million. Wind-powered electrification also reduces the demand for costly subsea cables and interconnectors, helping to lower capital and operating costs.

Regulatory compliance

Electrification of offshore platforms enables compliance with carbon pricing regimes and opens access to regulatory tax benefits, supporting emission reduction and financial health. By transitioning, companies can cut emissions, potentially qualifying for tax incentives and regulatory benefits. Additionally, companies can avoid the substantial expenses tied to emissions compliance – such as the USD 978 million that Equinor incurred in 2021 for EU carbon quotas and CO₂ taxes. Replacing generators also improves operational safety by decreasing the weight of onboard equipment and freeing up platform space.

Leveraging expertise

Firms can leverage their offshore installation expertise to streamline deployment of wind turbines, easing the transition to electrification. Advances in larger, more efficient wind turbines have also driven down costs, and oil companies’ installation capabilities can contribute to further savings in set-up and maintenance. This synergy between oil and renewables combines affordable clean energy with carbon capture and storage (CCS) to create "energy super basins".

Strategic alignment

By embracing renewable energy expansion, especially in offshore wind, companies align with global shifts in energy trends, enhancing competitiveness and ensuring resilience in the energy transition. Norwegian oil companies, for instance, are electrifying upstream operations to reduce carbon intensity and enhance investment appeal. PetroChina is following suit, intensifying efforts to replace fossil fuels with renewables to support a more diversified energy mix.

FURTHER READING

- Legal perspective on O&G electrification (Oxford Academic)

- OEUK decarbonisation conference 202 (Baringa)

- UK O&G Authority opportunity analysis (Oil & Gas Authority)