A significant development in the global investment landscape is the UN Principles for Responsible Investment (PRI)'s Spring initiative aimed at tackling biodiversity loss by 2030. This initiative comes as ESG investment practices face increased scrutiny, with doubts about their reliability and effectiveness growing. Research shows that more recent PRI signatories have displayed weaker integration of ESG standards compared to earlier members, raising questions about the efficacy of voluntary compliance systems in general. Reporting entities should adopt stricter accountability measures and collaborate with governments to improve biodiversity outcomes.

A tale of ESG and responsible investing

Global organisations face mounting pressure to align with stricter ESG standards or risk regulatory scrutiny and weakened market credibility

Policy

Global (all industries)

Publication date: 26 Sep 2024

By Eye For Business

AT A GLANCE

The weak integration of ESG standards among newer UN PRI signatories poses a risk to the credibility of responsible investment.

Beyond the UN PRI, this risk is significaint as it undermines voluntary compliance frameworks generally, increasing exposure to financial and reputational damage.

Inadequate ESG compliance could lead to regulatory scrutiny and loss of market trust.

Relevance of the UN PRI

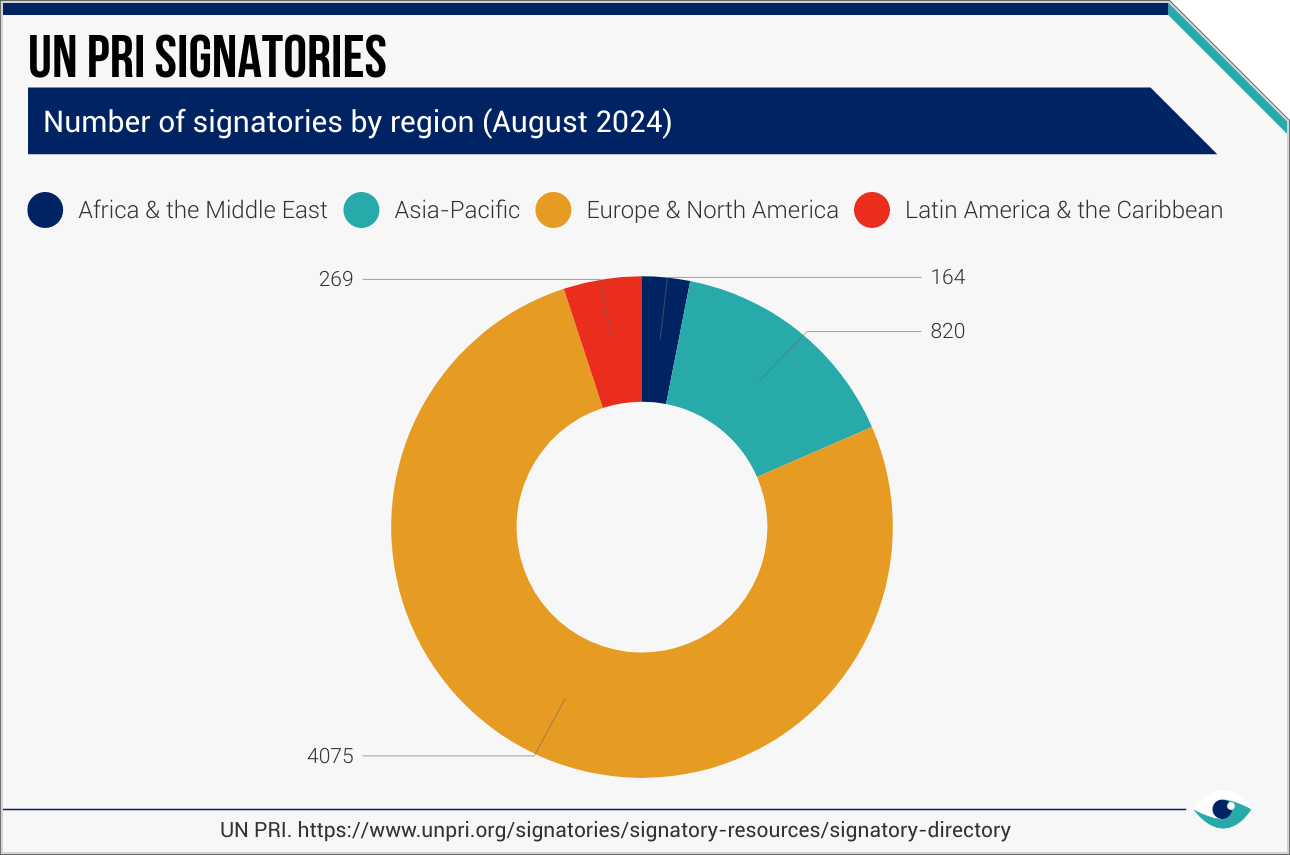

The continued relevance of the UN PRI is evident, with early signatories integrating ESG standards far more comprehensively into their operations than non-signatories. This strong commitment has positioned the UN PRI as a leader among responsible investment frameworks. Today, the initiative encompasses over 5,000 institutional members collectively managing around USD 120 trillion in assets. Since its inception, the UN PRI has driven the integration of ESG factors into investment decision-making, making it essential for promoting long-term sustainability in global financial markets.

ESG integrity and free-riding

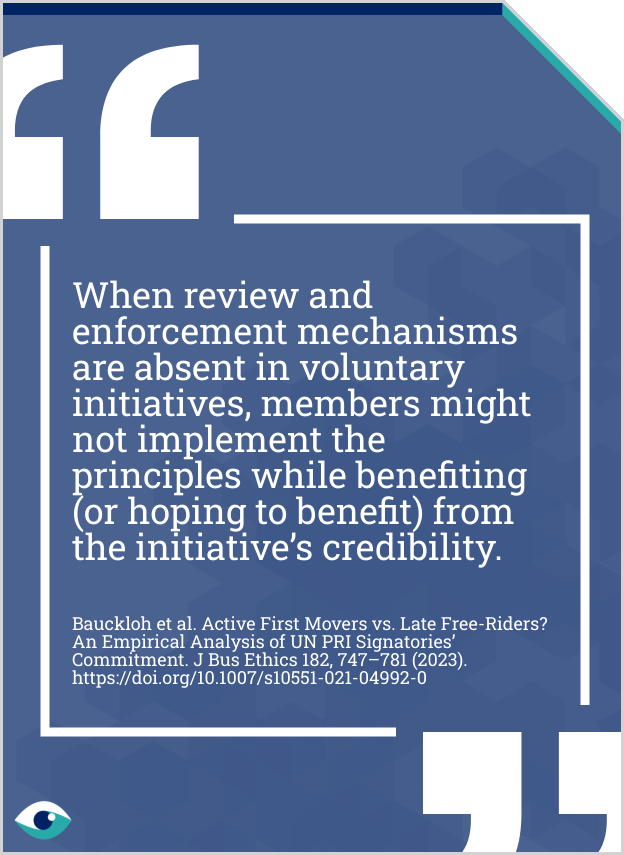

Yet some concern about the integrity of ESG practices have arisen due to the inconsistent performance of newer UN PRI signatories. Research suggests these members have shown a weaker commitment to integrating ESG standards than early adopters, raising doubts about the initiative's overall credibility. This uneven application of principles has led to questions about the effectiveness of voluntary compliance frameworks more generally. Late-stage signatories can undermine the long-term credibility and success of voluntary initiatives.

Collaboration with government

Collaboration between businesses and policymakers is essential for strengthening external perception of ESG. With governments increasingly focused on ambitious policies to tackle climate and biodiversity risks, business involvement becomes crucial. In the Global South, where participation in voluntary sustainability initiatives, including the PRI, is weaker, collaboration is especially vital to support sustainability and economic growth.

Business lobbying

Business advocacy for responsible regulation can advance sustainability. Investors are paying closer attention to the lobbying of investee entities, recognising the financial sector’s significant influence over corporate governance. By shaping regulations that favour meaningful sustainability-related action and reporting, investors help ensure that activities align with global efforts to improve biodiversity and climate outcomes.

FURTHER READING

- Spring Initiative (UN PRI)

- Active First Movers vs. Late Free‑Riders? (Journal of Business Ethics - 2021)

- PRI Strategy Plan 2024-27 (UN PRI)