Driven by global efforts and regulations to reduce greenhouse gas (GHG) emissions, the automotive industry is increasingly transitioning to electric vehicles (EVs), increasing the demand for lithium. This demand is expected to more than double by 2030. However, the lithium supply chain is challenged by geopolitical instability, environmental issues, and operational disruptions in key regions, with over 50% of lithium production occurring in high water stress areas. To mitigate these risks, the industry is advancing recycling technologies, forming long-term offtake agreements, and investing in direct mining ventures.

Is there enough lithium for mass Electric Vehicle adoption?

Recent findings show concerning levels of lithium

Value chain: upstream

Automotive

AT A GLANCE

By 2030, demand for lithium is set to more than double, due to its critical role in electric vehicles battery production.

Lithium supply is at risk due to geopolitical tensions, environmental issues and human rights concerns in key regions.

The automotive industry responds with lithium recycling, long-term agreements and vertical integration of the supply chain.

Rising demand

According to the International Energy Agency (IEA), 350 million EVs are expected to be sold globally by 2030, suggesting a significant rise in demand for lithium, which is crucial for battery production. Estimates project that demand for lithium will reach 1.5 million tonnes of lithium carbonate equivalent (LCE) by 2025 and more than triple to over 3 million tonnes by 2030. This increase is driven by the automotive industry and demand for clean energy technologies, such as wind and solar.

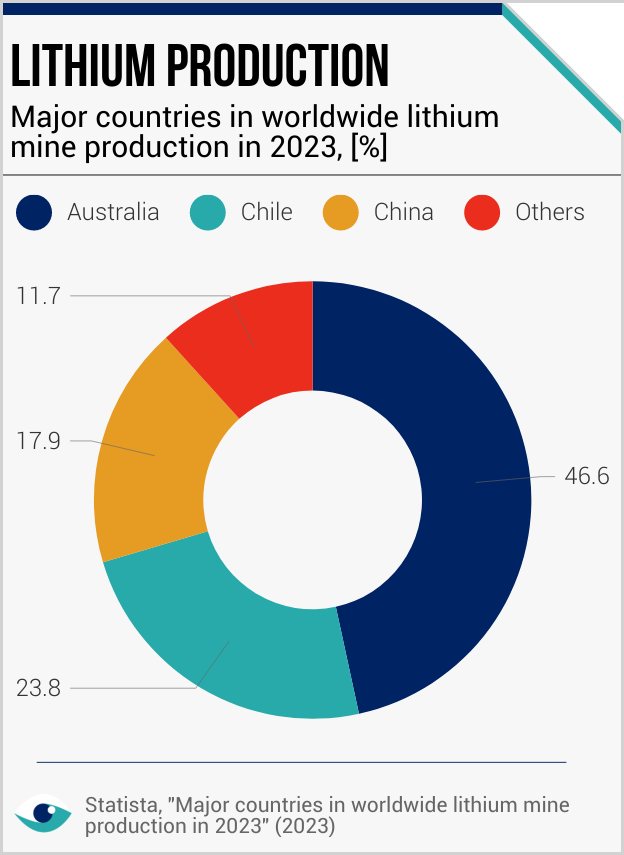

Supply risks

Lithium production is mainly concentrated in three countries: Australia, Chile and China, which together account for 90% of global output. Over 50% of production occurs in high water stress regions, increasing the supply risks. Additionally, around 40% of the global lithium output is sourced from mining projects with human rights concerns. Companies that reduce lithium dependency, secure sourcing, or develop alternatives can protect against supply disruptions and volatile input prices.

Supply chain risk management

Under the relevant SASB standard for the automotive industry, companies are required to disclose management strategies for risks associated with the use of critical materials like lithium. In response, the industry has been securing long-term offtake agreements to stabilise supply and investing directly in the critical minerals value chain, including mining and refining, as seen with General Motors and Tesla. Additionally, Volkswagen has disclosed efforts to recycle batteries to recover lithium.

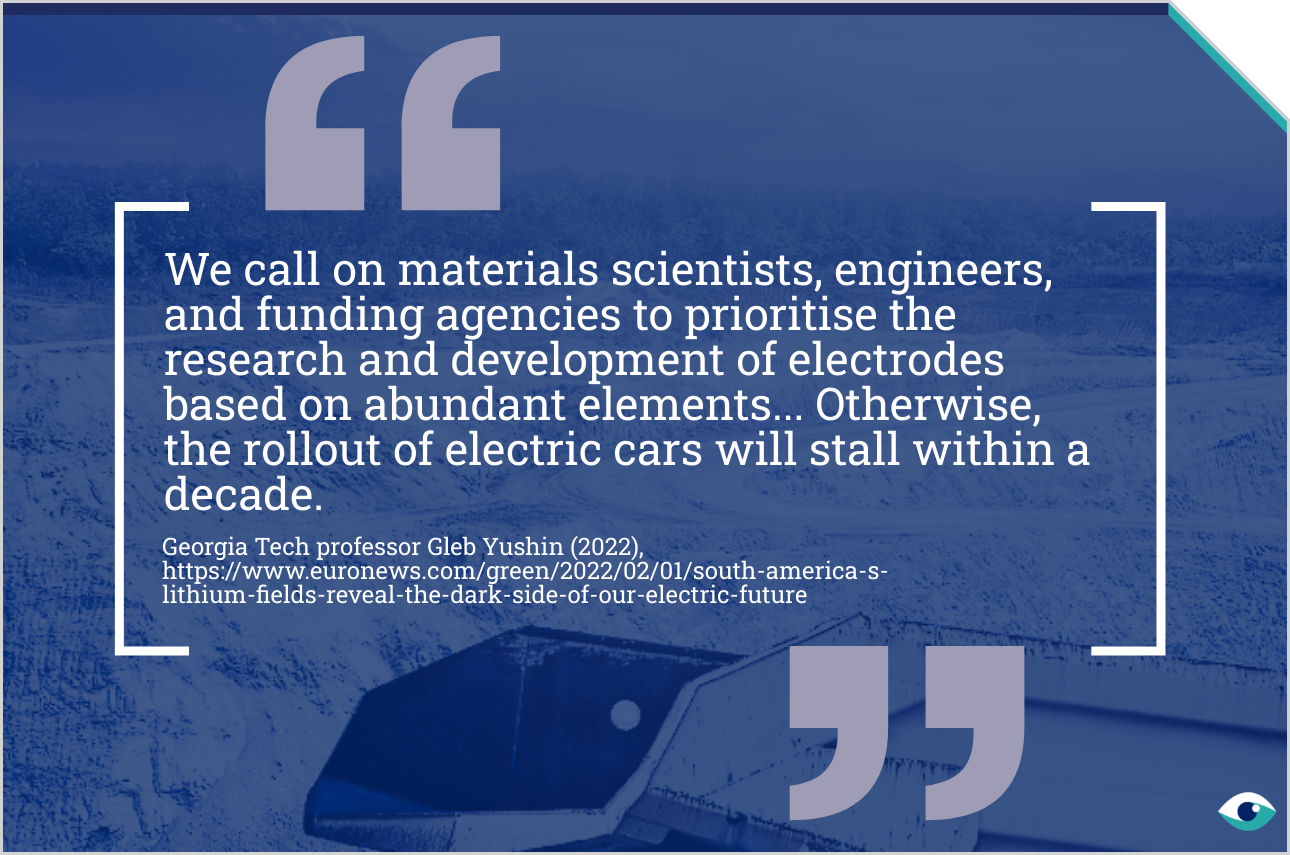

Future of lithium

The future of lithium supply is critical in achieving global climate goals, which include scaling up the production of EVs. The scientific community is actively involved in researching alternatives to lithium-ion systems, such as sodium-ion batteries. These batteries avoid the use of critical minerals, but face challenges in energy density and market adoption. However, with the clean energy industry also competing for these minerals, proactice global procurement strategies are needed to succeed.

FURTHER READING

- The future of lithium production (EnergyX)

- Trends in batteries (International Energy Agency)

- Australia's lithium potential (McKinsey)